No credit check peer to peer loans

Read on to find out the best no credit check loans guaranteed approval that you can apply for today. Personal installment loans banks personal loans and peer-to-peer loans between individuals.

How To Get A Personal Loan Personal Loans Loan Get A Loan

As weve warned it ISNT covered by the UK savings safety net which protects bank building society and credit union savings up to 85k per person per institution if.

. Our flexible terms mean that there are no late fees and we will always work with our customers to minimise default or bad debts. A variety of different types of loans can be made through online P2P credit providers. By connecting to your accounting software and bank accounts no-doc lenders can often fund a business loan by the next business day.

We compared and reviewed the best peer-to-peer lenders based on loan rates fees required credit score and more. Peer-to-peer loans lack the same liquidity that youd find in stocks or bonds. Before you use your cards check your available line of credit and your monthly interest rate.

Get the P2P instant loan and get things going right away. Our LC TM Marketplace Platform has helped more than 4 million members get over 70 billion in personal loans so they can save money pay down debt and take control of their financial future. Our peer-to-peer loans allow people of all credit histories to get access to the funds they need.

Or 12 months increments. Moreover these loans result in a credit check and you wont receive instant approval. When you lend money to individuals you risk them defaulting.

Since theres usually no credit check these loans can sound alluring to those who dont have a credit history and need cash quickly. Loan types include personal bank and peer-to-peer loans. Likewise they may be out of reach if you have bad credit.

Once you make an application they will assess your eligibility by looking at your credit score and circumstances. The best Buy Now Pay Later apps no credit check 2022 include Affirm and Klarna. Prosper is quick easy and trusted.

If you have poor credit youre most likely to be eligible for loan offers from companies which specialise in bad credit loans. As P2P finance is now easy and hassle-free. Peer to peer finance is basically the term used for the much useful financial innovation that unites verified money borrowers promise of perfection looking for unsecured personal loans with the financers expecting to earn high.

Whether your credit score is excellent or not you get a loan in the same way. No-doc business loans can be a good choice for small businesses owners that need short-term working capital fast. Typical loan durations range from three to 72 months.

Customers can apply to borrow 100 to repaid over 4 to 6 months in equal repayments. Peer-to-peer installment bank and short-term loans are all included in their portfolio. Check Rate With No Credit Risk.

Some students with no other alternatives use peer-to-peer lending sites. No matter what type of loan you choose always make sure that you understand all of your financial responsibilities before you sign on the dotted line. TitleMax is one of the longest operating online title loan providers with 1150 stores in 17 states.

Peer-to-peer lending sites dont come with FDIC insurance like a CD or saving account. There are two types of credit checks. Below is a summary of the best personal loans for bad credit along with links to each lenders secure online loan application.

Shop clothing electronics makeup furniture and more now. Prosper was founded in 2005 and was the first peer-to-peer lending marketplace in the United States. Can I Get a Loan with No Credit Check.

Peer to peer lenders who suffer bad debts on peer to peer loans from 6 April 2016 and relief conditions are met may also set these bad debts against interest received on other peer to peer loans. Peer-to-peer loans and secured personal loans are available on the platform An admirable maximum loan amount that goes up to 35000 Some of the lenders from the network are known for the. Peer-to-peer loans are funded by individual and institutional investors.

The good news is no matter what your personal loan needs are reputable lenders still want your business -- despite your imperfect credit history. P2P Credit is a FREE Peer to Peer Lending platform which matches qualified borrowers and investors with loans and investment servicing. Lenders on the network can choose to lend to individual borrowers.

Peer to peer payments or P2P payments are transactions that can be used for anything from splitting a dinner bill between friends to paying your rent. Every investment comes with some amount of risk and peer-to-peer lending is no exception. Accepting around 3000 new loans a day its incredibly easy to apply and qualify with cash being put into your bank account in roughly 30 minutes making it a great option for.

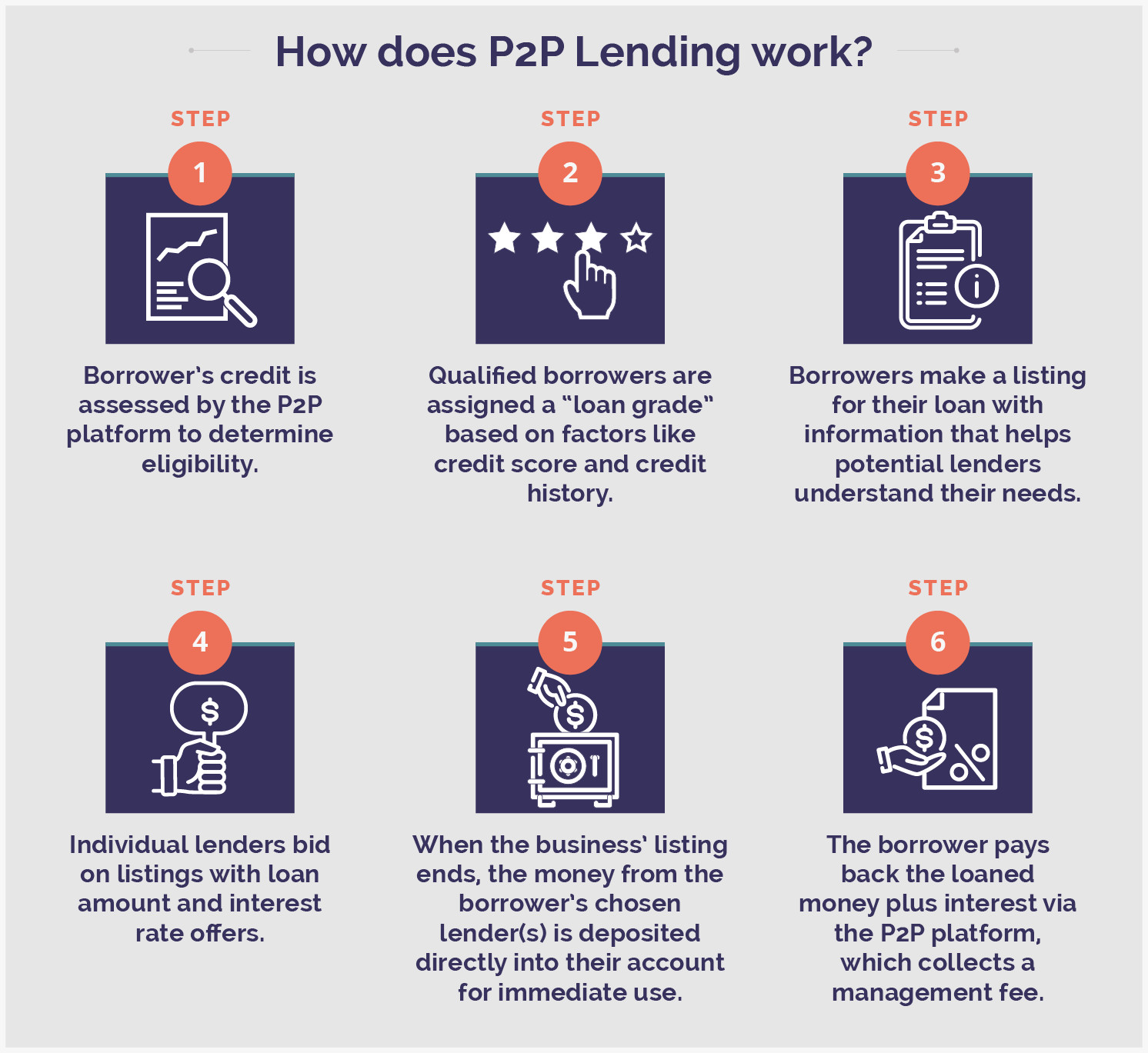

LendingClub is Americas largest lending marketplace connecting borrowers with investors since 2007. Here individuals who have extra money can lend it to others. The peer-to-peer site gauges the credit profile of the borrower and then provides general information to the lenders.

Loan Amounts up to 40000. This is a credit check that you initiate or does not. For example green loans for environmentally conscious.

Peer-to-peer lending is a special option that comes with its own requirements terms and conditions. Whats more they also offer personal loans. Peer-to-peer P2P lending looks like savings but with higher interest eg 5 acts like savings but smells like investing.

What is a bad credit score. Peer-to-peer P2P loans are available from a subset of online lenders called peer-to-peer lending platforms. Featuring fixed interest online loans and credit cards with next-day approval and flexible terms.

By applying to a lender. These payments allow the transfer of funds between two parties using their individual banking accounts or credit cards through a website or mobile app. They offer online car title loans for both cars and motorcycles.

These sites match potential borrowers with individual investors who want to make loans. And because we dont have any brick-and-mortar locations were able to keep. FAQs On Payday Loans Online With No Credit Check.

Here are 2022s best personal loans for bad credit. But for larger loans over 100000 even no-doc lenders might ask for some kind of paperwork.

Funny Quote Maybe P2p Lending Will Change This Peer To Peer Lending Business Loans P2p Lending

What You Need To Know When Applying For A Personal Loan Infographic Peerform Peer To Peer Lending Blog Personal Loans How To Apply Peer To Peer Lending

6 Best Online Peer To Peer Loans For Bad Credit 2022 Badcredit Org

Peer To Peer Lending Types Advantages

Here Is Everything You Need To Know About Peer To Peer Lending Peer To Peer Lending Peer Social Finance

U S Treasury Launches Study Of Peer To Peer Lending Learn More Http Buff Ly 1j49nx8 Online Lending Peer To Peer Lending The Borrowers

This Board Talks About A New And Radical Investment Option Peer To Peer Lending In Order To Encourage The Inve Peer To Peer Lending Peer Investment Portfolio

Personal Loan Apply Online Personal Loans Peer To Peer Lending Best Payday Loans

Top Options For Peer To Peer Business Lending Lantern By Sofi

Peer To Peer Lending Personal Loans Technology Loans Sme Loans Peer To Peer Lending Personal Loans Instant Cash Loans

A Review Of The Best Peer Lending Websites For Bad Credit Don T Think That All Peer To Peer Lending Is The Same Some Sites Credit Repair Loan Improve Credit

What Is Peer To Peer Lending Here Are 5 Things To Know P2p Lending Peer To Peer Lending Social Finance

Pin On P2p Lending India Infographics

3 Ways To Buy Your First Home With Bad Credit Canada Wide Financial Credit Repair Buying Your First Home Bad Credit

Pin On Peer Finance Money Tips Personal Finance

The Ultimate List Of Peer To Peer Lending Sites For 2020 In 2020 Lending Site Peer To Peer Lending Business Loans

Pin On P2p